Variable vs Fixed Home Loans: Which is Right for You?

Choosing between a variable and fixed interest rate is the most important decision you'll make when selecting a home loan. This choice will affect your monthly repayments, your total interest costs, and your financial flexibility for years to come.

With the Reserve Bank of Australia's cash rate sitting at 4.35% as of July 2025, and home loan rates averaging between 5.5% and 7.5% depending on your loan type and lender, understanding how different rate structures work is crucial for making an informed decision.

This guide will help you understand the key differences between variable and fixed rates, when each option makes sense, and how to choose the right approach for your financial situation. By the end, you'll have a clear framework for making this important decision with confidence.

Variable Rate Home Loans

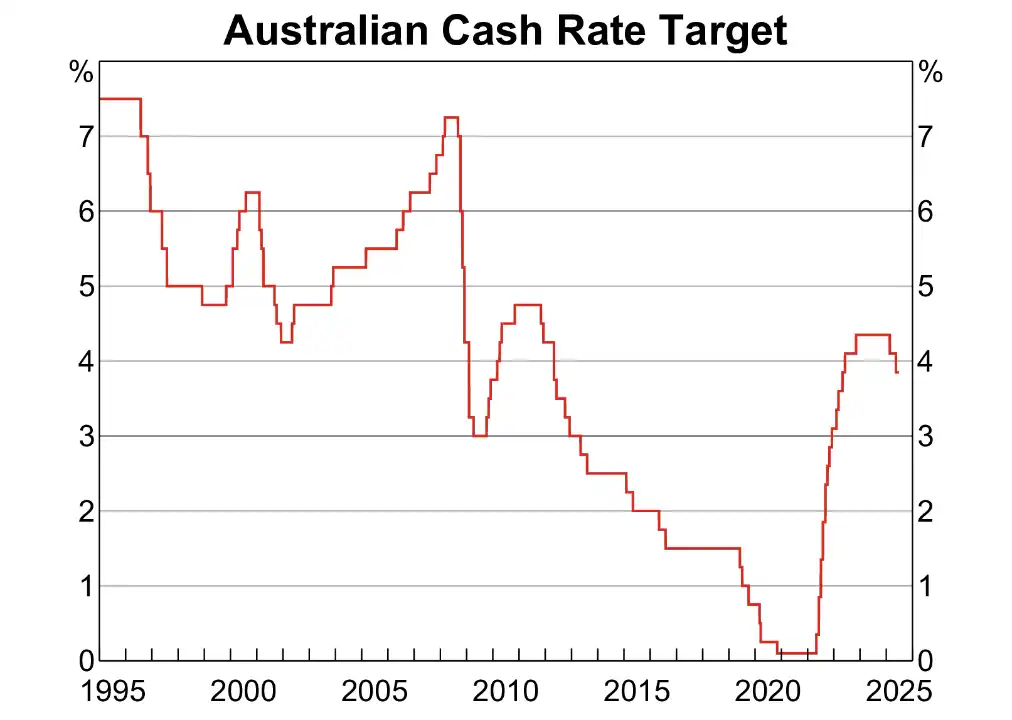

Image Credit: RBA

How Variable Rates Work

Variable rate home loans have interest rates that can change during the life of your loan. When the Reserve Bank of Australia (RBA) changes the official cash rate, or when lenders adjust their rates due to funding costs or competitive pressures, your interest rate and repayments can go up or down.

Current Market Context

As of July 2025, the RBA cash rate is 4.35%, with most variable home loan rates ranging from 6.0% to 7.5%. The cash rate has been relatively stable in recent months, but variable rates still fluctuate based on individual lender decisions and market conditions.

How Rate Changes Affect Your Repayments

When rates increase:

- Your monthly repayments increase

- More of each payment goes toward interest

- Your loan takes longer to pay off (if you keep the same payment amount)

When rates decrease:

- Your monthly repayments decrease

- More of each payment goes toward principal

- Your loan pays off faster (if you maintain higher payments)

Advantages of Variable Rates

Potential for Lower Costs: When rates fall, you immediately benefit from lower repayments and reduced total interest costs.

Flexibility: Most variable loans offer features like:

- Offset accounts

- Redraw facilities

- Extra repayments without penalties

- Ability to switch to fixed rates

No Break Costs: You can refinance or pay off your loan early without penalty fees.

Market Participation: You benefit from competitive rate cuts when lenders compete for customers.

Disadvantages of Variable Rates

Payment Uncertainty: Your repayments can increase unexpectedly, making budgeting more difficult.

Rate Rise Risk: If rates increase significantly, your repayments could become unaffordable.

Stress and Anxiety: The uncertainty of changing rates can cause financial stress for some borrowers.

Potential for Higher Long-term Costs: If rates trend upward over time, you'll pay more than if you had fixed your rate.

Who Should Consider Variable Rates?

Variable rates work well for borrowers who:

- Have steady income with room for higher repayments

- Want loan flexibility and features

- Believe rates are likely to fall or remain stable

- Can handle payment uncertainty

- Plan to pay off their loan quickly

- Want to take advantage of offset accounts or redraw facilities

Fixed Rate Home Loans

Image Credit: RBA

How Fixed Rates Work

Fixed rate home loans lock in your interest rate for a specific period, typically 1-5 years. During this time, your interest rate and repayments remain constant regardless of market changes.

Current Fixed Rate Environment

As of July 2025, fixed rates are generally available from:

- 1-year fixed: 5.8% to 6.8%

- 2-year fixed: 6.0% to 7.0%

- 3-year fixed: 6.2% to 7.2%

- 5-year fixed: 6.5% to 7.5%

These rates vary significantly between lenders and can change frequently based on market conditions.

What Happens When Your Fixed Period Ends

When your fixed term expires, your loan automatically reverts to the lender's standard variable rate unless you:

- Fix for another term

- Refinance to another lender

- Negotiate a new rate with your current lender

Advantages of Fixed Rates

Payment Certainty: Your repayments remain the same for the fixed period, making budgeting easier.

Protection from Rate Rises: You're protected if interest rates increase during your fixed term.

Peace of Mind: Knowing exactly what you'll pay each month reduces financial stress.

Planning Confidence: Fixed repayments make it easier to plan other financial goals.

Disadvantages of Fixed Rates

Higher Initial Rates: Fixed rates are often higher than variable rates at the time of application.

No Benefit from Rate Cuts: If rates fall, you won't benefit until your fixed term ends.

Limited Flexibility: Many fixed rate loans have restrictions on:

- Extra repayments (often limited to $10,000-$20,000 per year)

- Redraw facilities

- Offset accounts

Break Costs: If you want to exit early, you may face substantial break fees, especially if rates have fallen.

Reversion Risk: When your fixed term ends, you may face significantly higher rates.

Who Should Consider Fixed Rates?

Fixed rates work well for borrowers who:

- Have tight budgets with little room for higher repayments

- Prefer payment certainty over flexibility

- Believe rates are likely to rise

- Don't need loan features like offset accounts

- Plan to keep their loan for the full fixed term

- Want to avoid the stress of rate changes

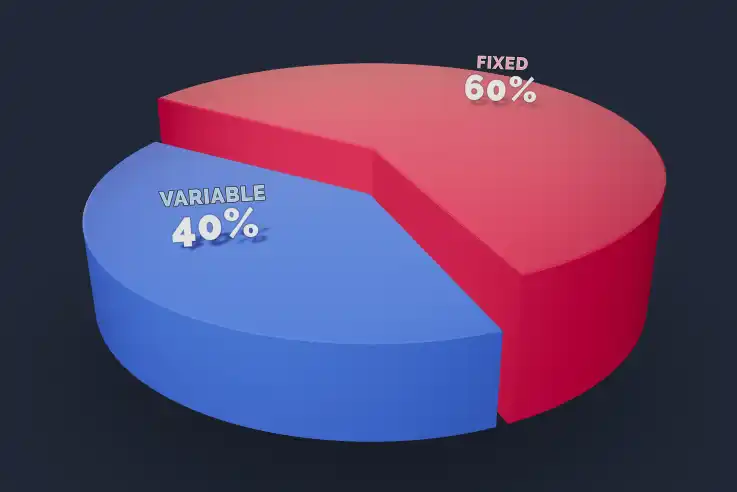

Split Loans

Image Credit: MoneyMart

Combining Variable and Fixed

Split loans allow you to divide your home loan between fixed and variable portions. For example, you might fix 60% of your loan and keep 40% variable, or any other combination that suits your needs.

Benefits of Split Loans

Balanced Risk: You get some protection from rate rises while maintaining flexibility and the potential to benefit from rate cuts.

Feature Access: The variable portion typically offers features like offset accounts and redraw facilities.

Hedged Approach: You don't have to make an all-or-nothing decision between fixed and variable.

Drawbacks of Split Loans

Complexity: Managing two loan portions can be more complicated.

Potential Higher Costs: You may pay separate fees for each portion.

Compromise Solution: You don't get the full benefits of either fixed or variable rates.

Common Split Combinations

50/50 Split: Equal balance between certainty and flexibility

70/30 Variable/Fixed: Mostly variable with some protection

60/40 Fixed/Variable: Emphasis on certainty with some flexibility

Who Should Consider Split Loans?

Split loans work for borrowers who:

- Want some payment certainty but also flexibility

- Can't decide between fixed and variable

- Have moderate risk tolerance

- Want to hedge against rate movements

- Need some loan features but also some protection

Decision Framework

Image Credit: Burst/Unsplash

Assessing Your Risk Tolerance

Low Risk Tolerance: If payment increases would cause significant financial stress, lean toward fixed rates.

Medium Risk Tolerance: Consider split loans or shorter fixed terms (1-2 years).

High Risk Tolerance: If you can handle payment fluctuations and want maximum flexibility, choose variable rates.

Financial Situation Factors

Stable Income: Higher income stability supports variable rate loans.

Tight Budget: Limited financial buffer suggests fixed rates for certainty.

Emergency Fund: Adequate savings provide cushion for variable rate increases.

Debt Levels: High existing debt may require payment certainty of fixed rates.

Loan Features Importance

Need Offset Account: Variable rates typically offer better offset account options.

Extra Repayments: If you plan to pay extra regularly, variable rates offer more flexibility.

Redraw Requirements: Frequent access to extra payments favors variable rates.

Portability: Variable loans often offer better portability options.

Market Cycle Considerations

Rather than trying to predict future rate movements, consider:

Current Rate Environment: Are rates historically high or low?

Rate Cycle Position: Has the RBA been raising or lowering rates recently?

Economic Conditions: Are there signs of economic growth or slowdown?

Your Loan Timeline: How long do you plan to keep this loan?

Evaluation Framework

Ask yourself these key questions:

- Can I afford repayments if rates rise by 2-3%?

- Do I value payment certainty over potential savings?

- Are loan features (offset, redraw) important to me?

- How long do I plan to keep this loan?

- What's my overall financial risk tolerance?

Real-World Scenarios

Image Credit: Roberto Nickson

Case Study 1: Sarah - First Home Buyer

Situation: 28-year-old teacher, stable income, tight budget, $80,000 deposit on $600,000 home.

Recommendation: 3-year fixed rate

Reasoning: Stable income but limited budget flexibility. Fixed rate provides payment certainty during the critical first few years of homeownership.

Case Study 2: Mike and Lisa - Young Professionals

Situation: Both in their early 30s, high combined income, growing savings, $150,000 deposit on $750,000 home.

Recommendation: Variable rate with offset account

Reasoning: Strong income growth potential, substantial savings for offset account, can handle payment fluctuations.

Case Study 3: David - Established Professional

Situation: 45-year-old accountant, stable high income, existing investment property, upgrading family home.

Recommendation: 60/40 split (variable/fixed)

Reasoning: Experienced borrower wanting some protection while maintaining flexibility for tax planning and investment strategies.

Case Study 4: Emma - Single Parent

Situation: 35-year-old single mother, moderate income, limited savings buffer, needs payment certainty.

Recommendation: 2-year fixed rate

Reasoning: Budget constraints require payment certainty, shorter fixed term provides some flexibility when renewed.

Making Your Choice

Image Credit: Aaron Burden

Your Decision Checklist

Financial Capacity

- Can I afford repayments if rates rise by 2-3%?

- Do I have an emergency fund of 3-6 months expenses?

- Is my income stable and growing?

Loan Features

- Do I need an offset account?

- Will I make extra repayments regularly?

- Do I need redraw flexibility?

Risk Tolerance

- Am I comfortable with payment uncertainty?

- Do I need payment certainty for budgeting?

- Can I handle financial stress from rate changes?

Loan Strategy

- How long do I plan to keep this loan?

- Am I likely to refinance in the next few years?

- Do I want to pay off my loan quickly?

Making the Final Decision

Remember that there's no universally "right" choice. The best option depends on your individual circumstances, financial goals, and risk tolerance. Consider:

- Your current financial situation

- Your future plans and goals

- Your comfort level with uncertainty

- The importance of loan features to you

Getting Professional Help

If you're still unsure, consider speaking with:

- A mortgage broker who can explain current market conditions

- A financial advisor who can assess your overall financial picture

- Your accountant if you have complex tax considerations

Summary

Variable rates offer flexibility and the potential for lower costs but come with payment uncertainty. Fixed rates provide payment certainty but limit flexibility and potential savings. Split loans offer a compromise between the two approaches.

Your choice should align with your financial situation, risk tolerance, and loan strategy. Don't be swayed by short-term market predictions – focus on what works best for your circumstances.

Ready to compare current rates? Use MoneyMart's comparison tool to see the latest variable and fixed rates from over 70 Australian lenders. Filter by your loan amount, deposit, and preferred features to find options that match your needs.

Next in this series: Learn about essential home loan features like offset accounts and redraw facilities, and discover which features could save you money or add valuable flexibility to your loan.

Disclaimer: This information is general in nature and doesn't consider your personal circumstances. Interest rates and loan terms change frequently. Consider seeking professional financial advice before making any decisions.*