Complete Beginner's Guide to Home Loans

Buying your first home is one of the biggest financial decisions you'll ever make and if the thought of navigating interest rates, loan terms, and banking jargon feels overwhelming, you're not alone – but you've come to the right place.

This complete beginner's guide is the first in a series of articles that aim to explain everything there is to know about home loans in a no fuss, easy to follow, way. By the end of this series, you'll understand the home loan process from start to finish, the different types of mortgages available, know the key players involved, and have a clear picture of your borrowing capacity. Most importantly, you'll have the confidence to take your next steps toward homeownership.

Whether you're a first-time buyer or simply want to understand how home loans work, this guide provides the foundation you need to make smart financial decisions.

Home Loan Basics

Image Credit: Tierra Mallorca / Unsplash

What is a Home Loan?

A home loan is money borrowed from a lender (usually a bank or financial institution) to purchase a property. The property itself serves as security for the loan, meaning if you can't make your repayments, the lender can sell the property to recover their money.

Understanding Principal vs Interest

Whilst there are several types of loans to choose from, and different payment options (which we'll cover later in the series), the most common repayment option for the vast majority of people (over 80%), is 'Principal & Interest'. So, it's good to know how this works. In this case your home loan consists of two main components:

Principal: This is the actual amount of money you borrow. If you buy a $500,000 home with a $50,000 deposit, your principal is $450,000.

Interest: This is the cost of borrowing the money, calculated as a percentage of the remaining principal. Interest rates in Australia typically range from 3% to 7%, depending on market conditions and your loan type.

How Repayments Work

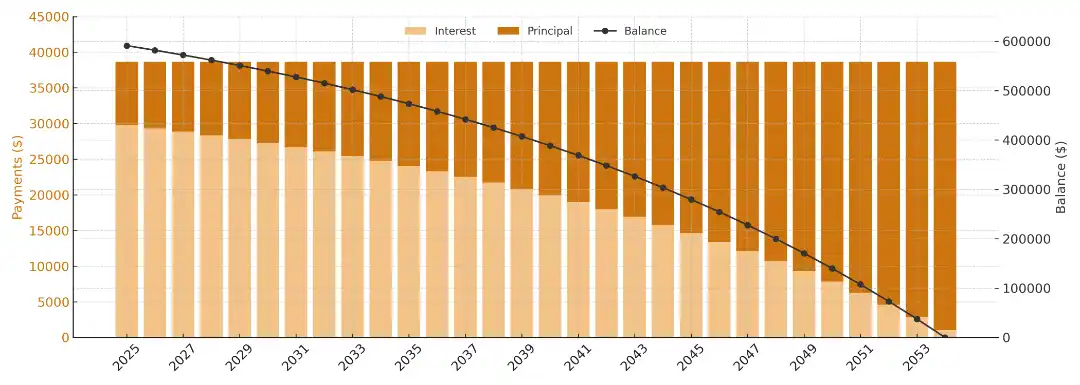

Now at some point this loan needs to be repaid. In most cases it is paid off in monthly instalments (although there are benefits to paying more frequently, and/or at higher amounts - which we'll get to later as well). With the 'Principal and Interest' mortgage repayment type, your monthly repayments are proportionally split into two components:

- A portion that reduces the principal (the amount you owe)

- A portion that covers the interest charged

Image Credit: MoneyMart

When you first start repaying your home loan most of your payment goes towards paying off the interest as the amount of interest is calculated against the full amount of the loan and is therefore a significant portion of your cost. As you pay down the principal over time, more of each payment goes toward reducing the actual debt, and less interest is charged as the sum of the principal is reducing.

Key factors

How much you can borrow, and how much it will cost you, in both the short and long term, is governed by 2 key factors:

Loan Term: The length of time you have to repay the loan. Typically a home loan is taken over a 25-30 year term, although shorter or longer terms are possible. Whilst spreading a mortgage over a longer period of time will reduce your monthly repayments, it can also significantly increase the amount of total interest you pay over time.

Example: paying off a $500k home loan, at 5%, over 30 years instead of 25 will cost you an extra $107k in interest over the term of the loan!

LVR (Loan-to-Value-Ratio: The loan-to-value ratio specifies what the percentage of the amount loaned (the 'principal' amount) against the value of the house bought (or that you want to buy). The higher the LVR then generally the higher the interest rate as it is considered a more risky venture to loan you the money. Some home loans, especially the lower interest ones, are often only available to those wanting to borrow money with a low LVR.

Example: If you want to buy a $600k house, and need to borrow $480k to do so, then your LVR is 80% so you will need to look at mortgages that allow for an 80% LVR.

Key Players in the Process

Image Credit: MoneyMart

Buying a home can seem daunting, especially the process of getting the actual home loan itself, from pre-approvals, to actual actual approvals. What do you need, and when? Can you bid on a house at auction if you don't have pre-approval for instance? Fortunately there are people and systems available to help you navigate this with ease:

Lenders

Banks: Whilst Commonwealth Bank, Westpac, ANZ, and NAB are the obvious choice for many for a home loan, there are also a number of regional banks, like Bendigo Bank and Bank of Queensland, that can often offer better rates. So it's good to spread your search beyond just the "Big Four".

Credit Unions: Member-owned financial institutions also offer home loans at competitive rates with often a service that feels more personal than larger banks.

Non-Bank Lenders: Companies like Pepper Money, Liberty Financial, and others that specialize in home loans without traditional banking services.

Supporting Professionals

Mortgage Brokers: Licensed professionals who compare loans from multiple lenders and help you find suitable options. They're typically paid by the lender, not you, but it's important to understand their role and potential conflicts of interest.

Comparison Websites: There a number of financial product comparison websites (including 'moneymart australia') that allow you to compare mortgage products yourself and/or offer financial brokerage services as well. These websites can be a great source of information but it also worth checking to see what range of financial institutes that they reference and whether they have any bias to any brands.

Valuers: These assess a property's worth to ensure it provides adequate security for the loan. They can also be a valuable resource for valuing a property before auction so as to know the properties market value and not just the value that the seller or agency wants to sell it at.

Solicitors/Conveyancers: These handle the legal aspects of property transfer and ensure all documentation is correct. Find one that suits your needs. If you want facetime with your solicitor then make sure they have a local office and it's easy for you to get there. If you'd rather do it all online then check out their website and online presence and check how much of the process can be done online. With most home loans there is always some aspect of 'in person' signatory required so bear that in mind when choosing.

Insurance Providers: Most lenders won't lend any money without knowing that there is insurance on the property, or they will make it a condition of the mortgage. There are plenty of insures around that offer this, and as with the home loan itself, it pays to shop around. Not only the well known brands but also some of the lesser known ones, or niche providers.

You!

All this would be a bit pointless of you weren't involved right? So, whilst it's good to know who is available to help, and who to involve at various stages of the home loan process, fundamentally you are responsible for providing accurate information, maintaining good credit, and understanding your obligations under the loan contract. Don't let that scare you though. For the majority of people that's not a problem. Just provide the information when people ask for it, and make sure you read the contracts.

The Home Loan Journey Overview

Image Credit: MoneyMart

Stage 1: Pre-Approval (1-2 weeks)

Whilst it can be super-exciting to just jump straight in there and start looking for houses (I know, I've done that too!), it's good to know how much you can borrow before you start. This is where getting a home loan pre-approval first proves useful as it helps you understand your borrowing capacity. You'll typically need to provide financial documents (typically bank statements) and fill out a credit assessment which will assess your spending habits, your income, and then be able to provide a conditional approval for a specific amount.

Stage 2: Property Hunting (Variable timeline)

With pre-approval in hand, you can now shop for properties within your budget with confidence. Your pre-approval is typically valid for 3-6 months. If you don't find a home within that time then the pre-approval will lapse and you will have to reapply. If re-applying with the same financial institution that gave you your first pre-approval then that process is typically easier. Some people find the house they love within a week, others take years. Just enjoy house hunting and find the one that's right for you.

Stage 3: Formal Application (2-4 weeks)

Once you've found the home of your dreams, and had your offer accepted, then you need to submit a formal loan application. If you already have a pre-approval then this process is quicker. Even with the pre-approval though banks might ask for a property valuation beforehand to ensure that the actual market value of the property is sufficient (this can be different from the amount you actually paid for it). Once the banks conditions are all met and satisfied then it's all ready for settlement.

Stage 4: Settlement (4-6 weeks)

The final stage is settlement and primarily involves signing off the final ticks in any legal documentation. This can be done in conjunction with a final property inspection to ensure that the home is in the condition that you originally saw it in. Once you're happy with that then the funds are transferred between the buyers and the sellers bank, and once the transfer is confirmed then typically the real-estate agent that was selling the house will hand you the keys. You are now the proud owner of your new home!

Critical Terms Every Borrower Should Know

Image Credit: MoneyMart

The home buying process can be filling with alot of legal jargon and definitions that can seem confusing if you don't know what they mean. So, here's a quick list to give you the lowdown:

Amortization: The process of gradually paying off your loan through regular payments over the loan term.

Security: The property you're purchasing serves as collateral for the loan.

LVR (Loan-to-Value Ratio): The percentage of the property's value that you're borrowing. If you buy a $500,000 home with a $400,000 loan, your LVR is 80%.

Loan Term: The duration of the home loan (typically 25 - 30 years)

Comparison Rate: The true cost of a loan, including the interest rate plus most fees and charges, expressed as a single percentage.

Lenders Mortgage Insurance (LMI): Insurance that protects the lender if you default on your loan, typically required when your LVR exceeds 80%.

Equity: The difference between your property's current value and the amount you still owe on your loan.

Offset Account: A transaction account linked to your home loan where the balance reduces the interest charged on your loan.

Redraw Facility: Allows you to access extra repayments you've made on your loan.

Fixed Rate: An interest rate that remains unchanged for a set period (usually 1-5 years).

Variable Rate: An interest rate that can change based on market conditions and lender decisions.

Honeymoon Rate: A discounted introductory rate that reverts to a higher rate after an initial period.

Establishment Fee: An upfront fee charged by some lenders to set up your loan.

Ongoing Fees: Regular charges such as monthly account-keeping fees or annual package fees.

Discharge Fee: A fee charged when you pay off your loan or switch to another lender.

Portability: The ability to transfer your existing loan to a new property.

Mortgage Broker: A licensed professional who can help you compare and apply for loans from multiple lenders.

Guarantor: Someone who agrees to be responsible for your loan repayments if you can't make them.

Bridging Finance: Short-term funding to help you buy a new property before selling your current one.

Interest-Only Repayments: Payments that only cover the interest charges, not reducing the principal balance.

Principal and Interest: Standard repayments that include both interest charges and principal reduction.

Cooling-Off Period: A short period after signing a contract where you can withdraw without penalty (varies by state).

Unconditional Approval: Final loan approval with no outstanding conditions.

Understanding Your Borrowing Capacity

Image Credit: Towfiqu barbhuiya / Unsplash

When seeking pre-approval for a home loan, or when applying for your actual loan, it is critical to understand the factors that can affect how much you can borrow.

Income Assessment

Lenders will evaluate your ability to repay based on factors such as:

Gross Income: Your total income before tax, including salary, bonuses, overtime, rental income, and other regular earnings.

Net Income: Your take-home pay after tax and other deductions. They will also factor in your living expenses (more on that shortly).

Income Stability: It's not just the amount you earn that plays a key part here, but also the stability of your income. If you're self-employed with an irregular income, or there are gaps in the income, then you will typically be assessed to be able to borrow less than someone who has been in permanent employment continuously for the last few years.

Living Expenses

Lenders use either your declared expenses or a benchmark figure (whichever is higher) to ensure you can afford repayments while maintaining your lifestyle. Your living expenses can include things such as:

Essential Expenses: Housing, food, utilities, transport, insurance, and minimum debt repayments.

Discretionary Expenses: Entertainment, dining out, hobbies, and subscriptions.

Debt Commitments: Credit card limits, personal loans, car loans, and other financial obligations.

The higher your living expenses, the less disposable income you will have and the less you will be able to borrow.

Credit Score Importance

Your history of borrowing, and you ability to repay loans that you have taken out in the past, be that a previous home loan, personal loan, credit card, or anything where you have had to borrow money (including 'buy now pay later' purchases), can all affect your credit score. This is a value that reflects your creditworthiness (ranging from 0-1,200). The higher the number the better the interest rates you will be able to access and the more likely it will be that you will be approved for a home loan. The lower your credit score than the less options will be available to you and you'll typically have to pay a higher interest rate too:

Excellent (833-1,200): Access to the best rates and terms

Very Good (726-832): Good loan options available

Good (622-725): Standard loan products accessible

Average (510-621): Limited options, higher rates

Below Average (0-509): Difficulty obtaining approval

Debt-to-Income Ratios

In order to assess how much you can borrow banks will be looking at your debt-to-income ratios. So how much you currently have as disposable after all existing debt is accounted for, and how that will be impacted if you were granted your home loan.

Gross Debt Service (GDS): Total housing costs shouldn't exceed 28-32% of gross income.

Total Debt Service (TDS): All debt payments shouldn't exceed 36-40% of gross income.

Whilst it can seem as though banks are doing everything in their power to ensure that you can't get a home loan, they really are just making sure that you are not borrowing beyond your limits and can actually afford the repayments that will be required on the home loan you are asking for.

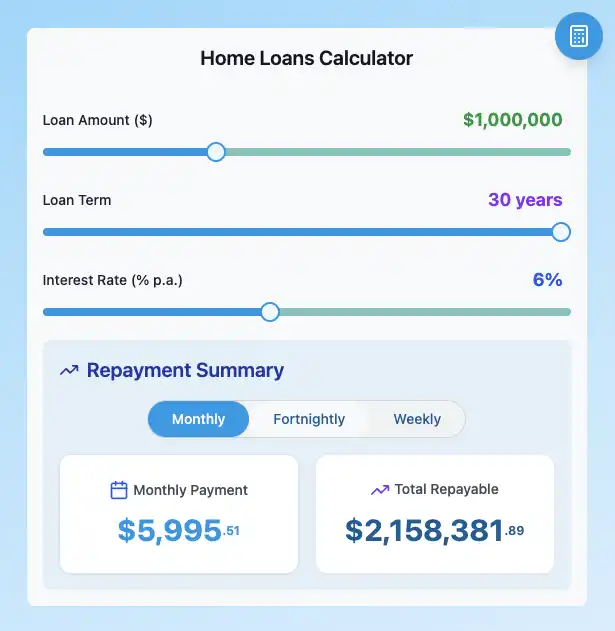

Using Online Calculators

Whilst getting pre-approval from a bank can let you know how much you can borrow, it's useful to do some homework yourself to estimate what your buying power might be. There's no point in looking at that million dollar home if you can't afford it! To that end there are plenty of online calculators that can quickly let you know what you repayments will be based on what you want to borrow so you can work out if that house if affordable or not, such as the online calculators available on the moneymart website.

Image Credit: MoneyMart

Whilst these calculators allow you to quickly and easily see repayment estimates based on changing house values, loan amounts, interest rates and loan terms, they are only estimates and typically don't take into account your everyday living expenses and should not be considered financial advice for what you can actually borrow. They are great tool for aiding your research though.

Factors That Impact Your Borrowing Capacity

Some things help increase your borrowing limit, whilst others can detract from it. Knowing what they are can help you increase your credit score and help you increase your borrowing capacity. Note that these are not quick fixes and any change in spending or saving habits can take a while before they positively, or negatively, affect your credit score. So, the sooner you start the better.

Factors that can Increase your borrowing capacity include:

Higher, stable income: Simple maths here. More consistent money in means more buying power, and lower risk.

Low existing debt: The less current debt you have the more money you can borrow. So if you have debt, such as credit card debt, then you'll want a plan for paying that off

Larger deposit: The larger you deposit on a house, the less money you will actually need to borrow. Your LVR will be lower too and so not only will you be able to borrow more, but you'll be able to get better interest rates too.

Good credit history: When you take out any form of borrowing (be that for a home loan, personal loan, credit card etc) make sure you pay it off on-time. This shows any financial institute that you can pay off the money you borrow and will increase your credit history.

Stable employment: The longer you are continuously employed for, the lower risk you are perceived to be.

Low living expenses: Still need to buy that mocha latte every morning or be subscribed to 5 different streaming services? Cut down on what you don't need to decrease your living expenses. This increases your borrowing potential.

Factors that decrease your borrowing capacity are really just the inverse of the above list. So if you have high cost of living, erratic employment, and a low deposit, that's all going to impact your ability to borrow. So, see where you can make some positive change. Your bank balance will thank you for it.

Next Steps

Image Credit: DESIGNECOLOGIST / Unsplash

Congratulations! You now have a solid foundation in home loan basics. You should now have a basic understanding of how loans work, who's involved in the process, how lenders assess your borrowing capacity, and what you can do to influence it.

Your Home Loan Journey Continues

Now that you understand the fundamentals, your next crucial decision is choosing the right type of home loan. The most important choice you'll make is between variable and fixed interest rates – a decision that can save or cost you thousands of dollars over the life of your loan.

Key Takeaways

- Home loans consist of principal and interest components

- Your property serves as security for the loan

- Multiple professionals support you through the process

- Your borrowing capacity depends on income, expenses, and credit score

- Pre-approval gives you confidence when property hunting

Ready to Take Action?

Calculate your borrowing capacity with MoneyMart's free online calculator. Get an instant estimate of how much you could borrow and start planning your property search with confidence.

Compare current home loan rates from over 70 lenders across Australia to see what's available for you.

Next in this series: Learn about Variable vs Fixed Home Loans and discover which option is best for you, and could save you money.

Disclaimer: This information is general in nature and doesn't consider your personal circumstances. Consider seeking professional financial advice before making any decisions.